Tata Group of companies launched their first IPO of TCS on 29-July-2004. The size of the IPO was Rs. 4713.47 Cr. And after two decades in 2023, Tata launched their another IPO which was of Tata Technologies. The total size of Tata Technologies IPO was Rs. 3,042.51 Cr.

Now after the huge opening of Tata Technologies, Tata Group set to launch more IPO’s very soon this year. If you want to invest in Tata Group of companies, here is the list of 5 IPO’s expected to launch this year.

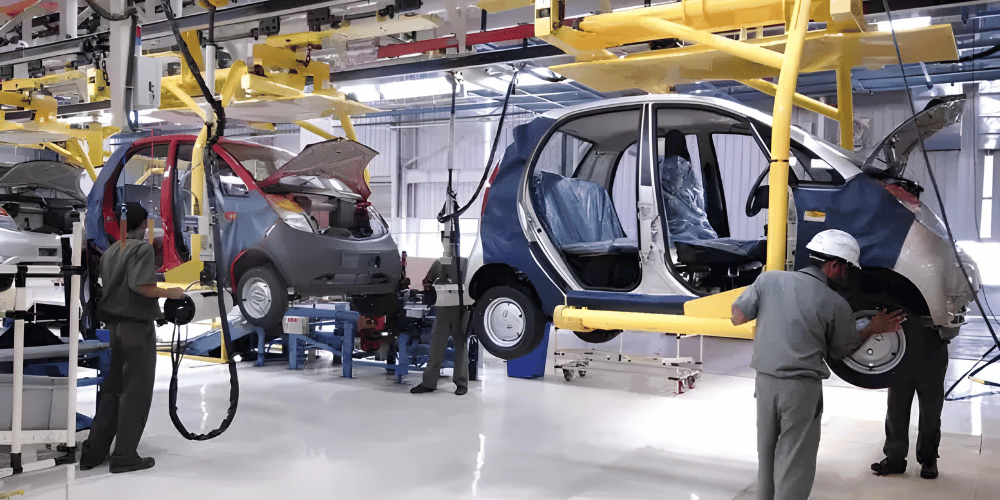

1. Tata Autocomp Systems

Tata AutoComp Systems Limited (Tata AutoComp) offers products and services to Indian and global automotive OEMs, as well as Tier 1 suppliers.

Tata AutoComp is a company with expertise in engineering, supply chain, sheet metal stamping, composites, and automotive interior and exterior plastics.

In collaboration with top businesses in the global auto component industry, Tata AutoComp has established nine joint ventures through which it produces and distributes automotive systems and components, including EV chargers, engine cooling solutions, automotive batteries, rearview mirrors, command systems, HVAC, exhaust and emission control systems, seating systems, battery pack, battery cooling systems, battery management systems, motors, controllers, integrated drivetrain (integrated motor, inverter, and reducer), and electronic solutions for both passenger and commercial vehicles.

The formal listing process is anticipated to start later this year. The Tata Group initiated talks to list Tata Autocomp Systems (TACO), its auto component manufacturing division, earlier this year. Total ownership of TACO is held by Tata Group companies, of which Tata Sons directly owns approximately 21% and Tata Industries Ltd. the remaining portion. TACO is the organization that leads the group’s automotive component business endeavors. It was established in 1995.

2. Tata Advanced Systems

Tata Advanced Systems Limited (TASL), a wholly owned subsidiary of Tata Sons, is the TATA Group’s strategic aerospace and defence arm. TASL is both an operating and holding company.

It provides services in aerostructures and engines, airborne platforms and systems, defense and security, and land mobility.

Tata Advanced Systems Limited is one of India’s leading private players in aerospace and defence solutions, aiming to be the ‘Partner of Choice’, particularly for the government’s ‘Make in India’ programme and global Original Equipment Manufacturers (OEMs).

According to the IPO Central report, Tata Advanced Systems (TASL) is another interesting Tata Group IPO planned for this year.

3. Tata Sons

Tata Sons, the parent company of the Tata Group, is planning another mega IPO. Tata Sons, which was classified as a ‘upper-layer’ NBFC (Non-Banking Financial Company) by the RBI last year, must list its shares by September 2025. Tata Sons’ IPO is expected to be the largest, or one of the largest, in India.

Tata Sons’ equity share capital is 66% owned by philanthropic trusts that fund livelihood creation, health, education, and the arts and culture.

4. Tata Play

Tata Play is an Indian satellite television (DTH) service provider that uses digital compression technology known as MPEG-4. The IPO for Tata Play, formerly known as Tata Sky, is anticipated to occur this year. SEBI has already given the go-ahead for it to move forward with the IPO. Although the exact date and specifics of the IPO are still unknown, this year is anticipated to see it happen.

5. Bigbasket

BigBasket is an India’s largest online food and grocery store headquartered in Bangalore, India, and currently owned by Tata Digital.

Bigbasket’s Chief Financial Officer Vipul Parekh disclosed in December 2022 that the Tata group-owned company plans to initiate an initial public offering within a span of 24 to 36 months. This suggests that Bigbasket’s IPO is anticipated to occur in the latter part of 2024 or early 2025.