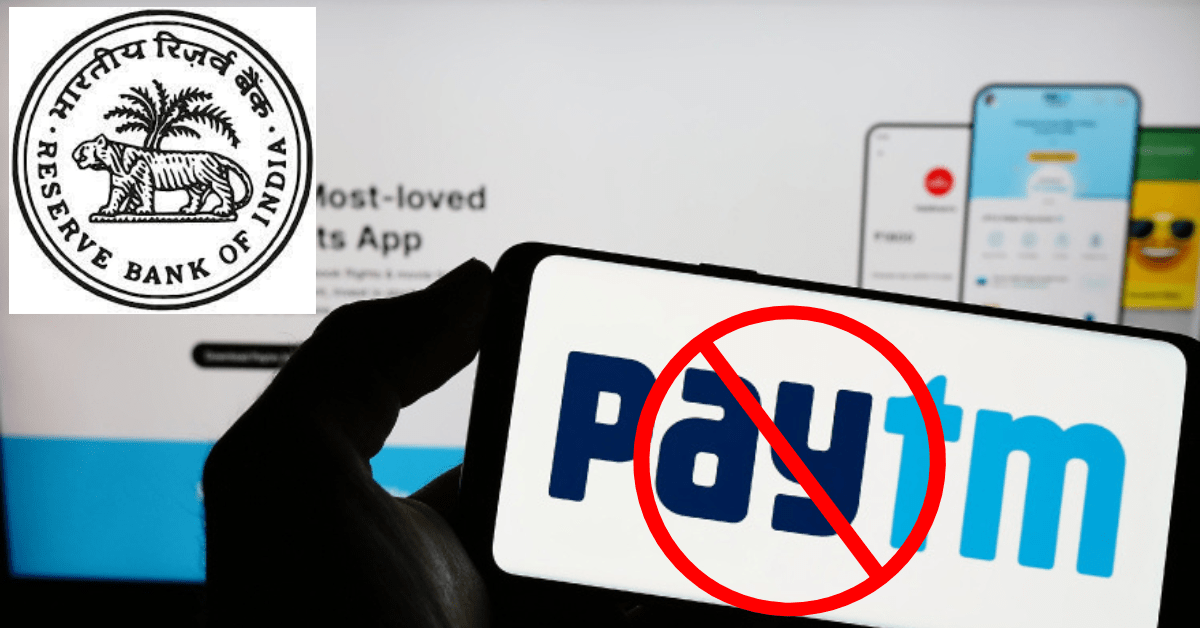

The Reserve Bank of India (RBI) severely damaged Paytm Payments Bank’s business on Wednesday, January 31, by forbidding the company from providing any of its essential services, such as wallets and accounts, starting in March.

Though the action severely restricts the company’s operations, it is not officially a cancellation of Paytm Payments Bank’s license.

The central bank has, however, permitted consumers to use or withdraw balance amounts “without any restrictions, up to their available balance.”

Once the face of India’s fintech revolution, Paytm has a sizable user base. Paytm Payments Bank claims to have more than 100 million know your customer (KYC) verified users on its website.

With more than 8 million FASTag units issued, we are also the biggest FASTag issuer, according to the website.

Paytm founder and Chairman Vijay Shekhar Sharma is part-time chairman of the bank.

What’s stated in the RBI directive?

Due to “persistent non-compliances and material supervisory concerns,” Paytm Payments Bank was prohibited from providing nearly all of its core services after February 29. These services included accepting deposits or top-ups in any customer account, prepaid instruments, wallets, FASTags, National Common Mobility Card (NCMC), etc.

“After February 29, 2024, the bank should not provide any other banking services, such as fund transfers (regardless of the name and type of services, such as AEPS, IMPS, etc.), BBPOU, or UPI facility,” the RBI has declared.

It has mandated that the parent company One97 Communications’ and Paytm Payments Services’ nodal accounts be closed as soon as possible, but no later than February 29.

The central bank has stated that no transactions will be allowed after March 15 unless all pipeline transactions and nodal accounts have been settled, with regard to all transactions started on or before February 29.

Can users access or remove the money they have stored in different Paytm devices?

Customers may withdraw or use funds from their Paytm accounts, including savings bank accounts, current accounts, prepaid cards, FASTags, NCMC, and other products, “up to their available balance,” without any limitations, according to the RBI.

A number of other services, including credit cards, loans, mutual funds, bill payment, digital gold, and bill payment, are not mentioned in the RBI statement.

What is Paytm’s statement regarding the RBI’s action?

One97 Communications Ltd. said that it was “taking immediate steps to comply with RBI directions” as Paytm shares fell 20% on the exchanges on Thursday, February 1. This included collaborating with the regulator to promptly address their concerns.

The company anticipates that the RBI action will, in the worst-case scenario, have an impact on its annual EBITDA (earnings before interest, tax, depreciation, and amortisation) of Rs 300–500 crore going forward, depending on the nature of the resolution.

Additionally, One97 Communications stated in an exchange filing that going forward, it will only collaborate with other banks and not with Paytm Payments Bank.

Along with a number of the nation’s top banks, we provide merchants with acquiring services, and we’ll keep growing our alliances with other banks. Current Paytm Payment Gateway customers will still be able to access payment options from the company, according to a statement.

As usual, OCL will continue to offer its offline merchant payment network services, such as Paytm QR, Paytm Soundbox, and Paytm Card Machine. Additionally, Paytm stated that it is able to onboard new offline merchants.

How did the RBI take action against Paytm?

The central bank did not explain its decision. But since 2018, the RBI has been closely examining Paytm Payments Bank.

According to sources, the RBI may have taken action because of worries about IT-related problems and KYC compliance. The central bank is worried about letting any organization or banking body put depositors’ money at risk in this way.

According to information obtained, the RBI also reportedly looked into Paytm Payments Bank and its parent company OCL for allegedly not having the necessary information barriers within the group and for providing data access to Chinese entities that indirectly owned the payments bank through their ownership of the parent company.

The RBI’s most recent action was reportedly prompted by its prolonged inability to address these issues at several levels, according to information obtained.

One97 Communications is a shareholder of Antfin, an affiliate of the Chinese conglomerate Alibaba; according to stock exchange data, as of December 31, 2023, Antfin held a 9.89% stake in the company. Chinese investments in Indian companies have come under close scrutiny from Indian regulators, given the tense relationship between China and India in recent years.

What additional steps has RBI already taken to address Paytm?

Paytm Payments Bank was fined Rs 5.39 crore by the RBI in October 2023 for noncompliance with regulations. The regulator claimed that the payments bank had violated several regulations by failing to identify the beneficial owner of entities it had onboarded for payout services, failing to monitor payout transactions and perform risk profiling of entities receiving payout services, exceeding the regulatory cap on the end-of-day balance in some customer advance accounts, and failing to report a cyber security incident on time.

The RBI ordered Paytm Payments Bank to cease onboarding new customers immediately in March 2022. The RBI stated on January 31 that “persistent non-compliances and continued material supervisory concerns in the bank” were found in the Comprehensive System Audit report and the external auditors’ subsequent compliance validation report, which called for additional supervisory action.

Prior to 2022, the central bank had already noted in 2018 some aspects of the procedures the business used to bring on new users, particularly with regard to KYC standards.

The close ties between Paytm Payments Bank and its parent company One97 Communications also raised concerns for the RBI. Payments banks have to keep a safe distance from companies in the promoter group. Vijay Shekhar Sharma, the creator of Paytm, owned 51% of the shares in Paytm Payments Bank, while OCL owned 49%.

Additionally, there were claims that the payments bank had overdrawn its account balance of Rs 1 lakh, which was the maximum amount that payments banks were permitted to keep at the time, and had not fulfilled the Rs 100-crore net worth requirements.

Paytm share price

As the stock hit its 20% lower circuit for the second straight session on Friday, February 2, the Paytm share price continued to experience intense selling pressure.

The price of Paytm’s shares opened at ₹487.05, 20% below its previous closing on the BSE on Friday of ₹608.80.

In response to RBI action on Paytm Payments Bank (PPBL), the share price of Paytm fell by 20% during the prior session on Thursday as well.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?