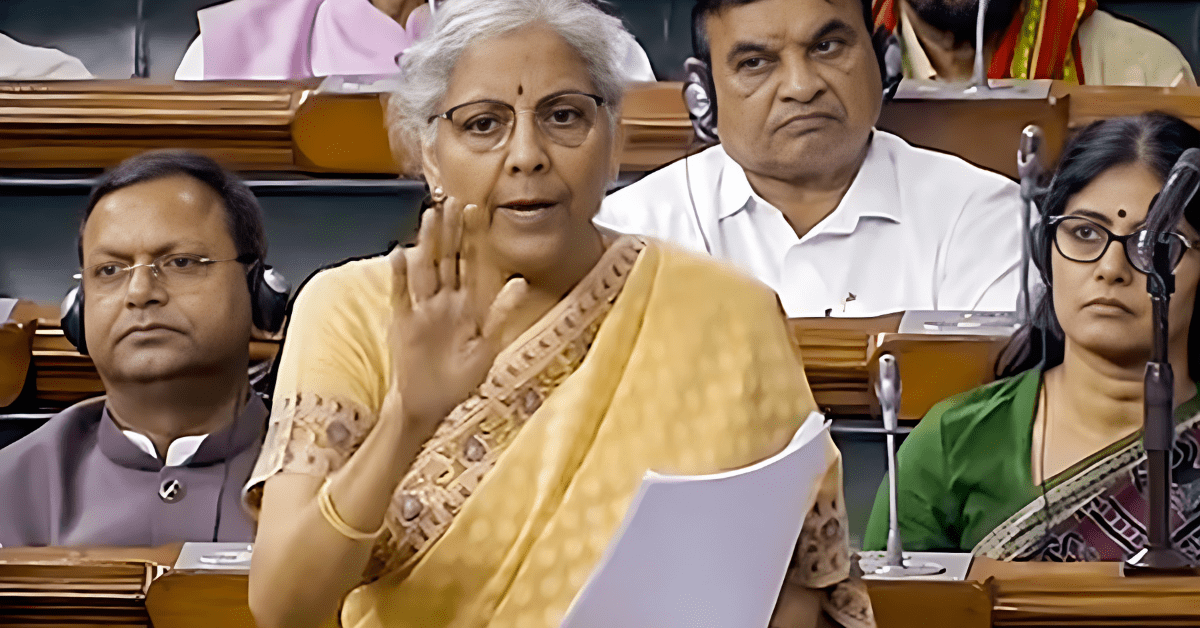

Budget 2024 Key Highlights: Finance Minister Nirmala Sitharaman introduced the Interim Union Budget for the fiscal year 2024–25 in the Parliament earlier today. This was the last budget of the second term of the government headed by Prime Minister Narendra Modi and the sixth one presented by the current FM.

After the formation of the new government following the Lok Sabha Elections, the entire budget will be presented in July of this year.

Railways, infrastructure, agriculture, green growth, and fiscal consolidation were the budget’s main interests. This disappointed salaried people because no adjustments were made to the tax rates.

The FY24 target was also revised down to 5.8% of GDP, and the Fiscal Deficit target for FY25 was set at 5.1 percent of GDP, better than anticipated. In the meantime, ₹11.1 lakh crore, or 11.1 percent, more was allocated to capital expenditures in FY25.

“The Indian economy has witnessed a positive transformation in the last 10 years. People are looking towards the future with hope. In 2014, the country was facing enormous challenges. With Sabka Saath, Sabka Vikaas, the Narendra Modi-led government overcame those challenges,” said Finance Minister Sitharaman in her budget speech.

According to Sitharaman, the next five years will see unheard-of growth as the nation works toward its 2047 development goal. She stated that the “trinity of democracy, demography and diversity can fulfill aspirations of every Indian”. Experts think that this budget met their expectations as well.

“The FM has continued to focus on strengthening domestic macro factors, such as ongoing investments in domestic tourism, agriculture, and infrastructure. It has also stuck to fiscal responsibility, lowering the fiscal deficit, which may please foreign investors. In addition, a $25 billion bond is set to be included in June, as lower borrowing costs and budget deficits will help drive down yields. According to Pradeep Gupta, co-founder and vice-chairman of the Anand Rathi Group, “it might pave the way for an improvement in ratings.”

The budget places a strong emphasis on tourism, logistics, infrastructure, and innovative research. The economy will continue to grow sustainably as a result of all these initiatives. According to Gupta, this demonstrates the current government’s ongoing commitment to implementing fiscal prudence and achieving the desired fiscal deficit of 4.5 percent of GDP by FY26.

Let’s examine the 14 main features of the 2024 Budget, which range from income tax to green energy and tourism:

Income Tax

” I do not propose any changes in tax rates in direct and indirect taxes including import duties,” Sitharaman said, during her Budget speech.

The FM declared that tax collections have more than doubled over the past ten years, despite the fact that the tax regime remained unchanged in this budget. She also mentioned that this year’s average tax return processing time was lowered to 10 days.

Infrastructure Development

The FM said that the capital expenditure budget for the upcoming year will rise by 11.1 percent to 11.11 lakh crore, building on the massive tripling of the budget for capital expenditures over the previous four years, which had a huge multiplier effect on economic growth and job creation. 34% of the GDP is represented by this.

Railways

In order to improve passenger safety, convenience, and comfort, FM Sitharaman declared that 40,000 standard rail bogies will be converted to Vande Bharat. There will be more city expansions for important rail infrastructure initiatives like Metro Rail and Namo Bharat.

Three major railway corridors were also announced: the high traffic density corridor, the port connectivity corridor, and the energy, mineral, and cement corridor.

Passengers will travel faster and in greater safety as a result of the improved passenger train operations brought about by the subsequent decongestion of the heavily traveled corridors.

These three economic corridor projects will lower logistical costs and boost GDP growth in conjunction with freight corridors specifically designated for that purpose, according to Sitharaman.

Following the triumph of the Vande Bharat trains, the FM declared that approximately 40,000 additional rail bogies will be transformed into Vande Bharat coaches. This will shorten travel times, boost domestic tourism, and generate more job opportunities nationwide, according to Sanjay Moorjani, Research Analyst at SAMCO Securities.

Congestion on current lines, primarily in the country’s east, can be eased by the creation of economic rail corridors tailored to specific commodities, according to CRISIL. Faster freight movement and turnaround times are encouraged by this, which should also help India cut its logistics costs from 12% of GDP and increase its competitiveness relative to its peers, particularly in manufacturing.

‘Lakhpati Didi’ Scheme

FM declared that nine crore women and eighty-three lakh SHGs (self-help groups) are changing the socioeconomic landscape of rural areas through empowerment and independence. Almost one crore women have already benefited from their success by becoming “Lakhpati Didis.” Encouraged by the outcome, the goal for “Lakhpati Didi” has been increased from 2 crore to 3 crore.

Electricity

Ten million households will be able to receive up to 300 units of free electricity per month through roof-top solarization. According to FM Nirmala Sitharaman, this plan reflects the Prime Minister’s resolve on the historic day of the Shri Ram Mandir’s consecration in Ayodhya. According to Sitharaman, households will be able to save up to ₹15,000–18,000 a year by taking advantage of free solar electricity and selling the excess to distribution companies.

Green Energy

In an effort to reach the goal of “net zero” by 2070, the following actions were declared.

a. Funding for the viability gap will be given in order to utilize offshore wind energy potential up to a gigawatt in initial capacity.

b. By 2030, a 100 MT coal gasification and liquefaction capacity will be established. Additionally, this will lessen the need to import ammonia, methanol, and natural gas.

c. It will be necessary to gradually blend compressed biogas (CBG) into piped natural gas (PNG) for home use and compressed natural gas (CNG) for transportation.

d. To facilitate collection, financial support will be given for the purchase of biomass aggregation equipment.

Electric Vehicles

According to the finance minister, the government will boost infrastructure for EV manufacturing and charging in order to grow and fortify the EV ecosystem. Through payment security mechanisms, a greater uptake of e-buses for public transportation networks will be encouraged, she continued.

Agriculture and food processing

FM declared that more will be done to increase farmers’ incomes and add value to the agricultural sector. 38 lakh farmers have benefited from the Pradhan Mantri Kisan Sampada Yojana, which has also created 10 lakh jobs. Formalization of Micro Food Processing Enterprises under Pradhan Mantri Yojana has helped sixty thousand people and 2.4 lakh Self-Help Groups establish credit connections. In addition, there are other programs aimed at lowering postharvest losses and raising incomes and productivity.

She said that in order to guarantee the industry grows more quickly, the government will encourage both public and private investment in post-harvest operations such as aggregation, contemporary storage, effective supply chains, primary and secondary processing, marketing, and branding.

MSME

The goal of policy is to equip MSMEs with the skills they need to compete on a global scale, and supporting their expansion will be crucial. According to FM Sitharaman, the government will get the financial sector ready to meet the investment needs.

PM Awas Yojana

PM Awas Yojana (Grameen) implementation proceeded despite COVID-related obstacles, and the center is almost at the three crore house target. In order to accommodate the demand brought on by the rise in the number of families, two crore more homes will be built over the course of the next five years, according to Sitharaman.

Ayushman Bharat

Finance Minister Sitharaman declared that all Anganwadi and Asha workers would now be covered by Ayushman Bharat. She also mentioned that a single, all-inclusive plan will replace all maternity and child healthcare programs.

Tourism

FM declared that states would be urged to embark on a comprehensive development of global branding and marketing strategies for famous tourist destinations. There will be a system of ratings based on how well-maintained the facilities and services are. States will be given long-term, interest-free loans to help fund these developments. On all of our islands, including Lakshadweep, projects pertaining to port connectivity, tourist infrastructure, and amenities will be undertaken. Additionally, this will aid in creating jobs, according to FM Sitharaman.

Promoting investments

A golden period was marked by the $596 billion in FDI inflow between 2014 and 2023. That amounts to twice the influx from 2005 to 2014. In keeping with the principle of “first develop India,” the government is negotiating bilateral investment treaties with foreign partners to promote sustained foreign investment, the FM stated in her speech.

Technology

Businesses and people’s lives are changing as a result of new age technologies and data. According to FM Sitharaman, they are also making it possible for new economic opportunities to arise and for everyone, even those at the “bottom of the pyramid,” to receive high-quality services at reasonable costs.

She declared that a fifty-year interest-free loan will be used to establish a corpus of one lakh crore rupees. Long-term financing or refinancing with long tenors and low or no interest rates will be made available by the corpus. The private sector will be encouraged to greatly increase research and innovation in sunrise domains as a result.

other key numbers

- The goal for the FY25 budget deficit is 5.1% of GDP.

- The budget deficit goal for FY24 was lowered from 5.9 percent of GDP to 5.8 percent.

- The fiscal deficit for the first nine months of FY24, ending in December, was ₹9.82 lakh crore, or 55% of the yearly projection.

- FY25 capital spending is expected to be ₹11.1 lakh crore, an increase of 11.1 percent.

- ₹30.80 lakh crore is anticipated to be spent overall in FY25. The updated projected total cost for FY24 is ₹44.90 lakh crore.

- Strong growth momentum and economic formalization are expected to translate into revenue receipts for FY24 of ₹30.03 lakh crore, which is expected to exceed the Budget estimate.

- With a net borrowing of ₹11.75 lakh crore, gross market borrowing for FY25 is estimated to be ₹14.13 lakh crore.

- Aim for ₹26.02 lakh crore in gross tax receipts for FY25.

Also Read: Budget 2024: 8 Interesting Facts About India’s Union Budget

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!