The National Stock Exchange introduced the market index known as NIFTY. The term was combined from National Stock Exchange and Fifty, and it was first used by NSE on April 21, 1996. Out of a total of 1600 stocks, the top 50 equity stocks traded on the stock exchange are displayed in the benchmark-based NIFTY 50 index, which is also the flagship of the NSE.

Twelve sectors of the Indian economy are represented by these stocks: consumer goods, financial services, information technology, metals, pharmaceuticals, telecommunications, cement and related products, cars, energy, fertilizers and pesticides, and other services.

NIFTY is one of the two national indices; the other is the Bombay Stock Exchange-produced SENSEX. The National Stock Exchange Strategic Investment Corporation Limited, a wholly owned subsidiary, owns it through India Index Services and Products (IISL).

The NIFTY 50 index tracks the movements and tendencies of blue-chip companies, or the biggest and most liquid Indian stocks.

NIFTY is a group of indices that are part of the NSE’s Futures and Options (F&O) segment, which deals with derivatives. These indices include NIFTY 50, NIFTY IT, NIFTY Bank, and NIFTY Next 50.

How NIFTY is Calculated?

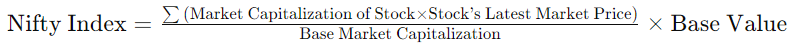

Out of 50 actively traded stocks across multiple sectors, the Nifty 50 comprises them. Based on variables like market capitalization, trading activity, and liquidity, a choice is made. The index is a market-capitalization-weighted index, which means that the weight of each stock in the index is based on its market capitalization.

However, the market capitalization is calculated using the free-float methodology. Free float refers to the number of shares that are available for trading in the market, excluding locked-in shares, promoter holdings, and other strategic holdings.

The Formula to calculate NIFTY is:-

- The base year for the Nifty is 1995 and the base value is set at 1000.

To make sure it keeps reflecting the state of the market, the Nifty is rebalanced on a regular basis. Changes in market capitalization, liquidity, and other variables may result in the addition or removal of stocks. To ensure that the value of the Nifty index remains constant over time, the index’s divisor may need to be changed in response to different corporate actions like stock splits and bonuses.

Eligibility For NIFTY Indexing

Typically, high market capitalization stocks are chosen to be part of the Nifty 50. As part of the free-float methodology, the market capitalization is determined by taking into account the shares that are available for trading. High liquidity is a requirement for stocks chosen for the Nifty 50. The impact cost—the price of carrying out a transaction in a specific stock—and the average daily traded value are two indicators of liquidity.

The percentage of shares that are available for trading on the market is represented by the free float factor. In the index, stocks with greater free float factors are assigned a higher weight. The government, other strategic holdings, and promoter holdings are among the factors that go into determining the free float factor.

The Nifty 50 seeks to reflect a range of economic sectors. Periodically, the index’s composition is examined to make sure it accurately represents the state of the market and the economy as a whole. Stocks from a variety of industries, including energy, healthcare, finance, and IT, are typically included in the index.

The selection process takes into account the companies’ financial performance. Strong financials and a history of reliable performance may increase a company’s chances of inclusion. The NSE may also take corporate governance and compliance-related factors into account. In general, businesses with sound corporate governance procedures are favored. For a stock to be eligible for the Nifty 50, it must be listed and traded on the NSE. There should be enough history of trading in the stock on the exchange.

How Can Anyone Invest In NIFTY

- Acquire the individual stocks in the proportion that they appear in the index to form the Nifty 50. Investors may need to periodically rebalance their portfolios to reflect changes in the Nifty 50 composition, and this strategy necessitates study and understanding of each stock.

- Exchange-traded funds (ETFs) that track the Nifty 50 index’s performance are a good way to invest. Because exchange-traded funds (ETFs) are traded on stock exchanges in the same manner as individual stocks, investors can easily obtain exposure to the entire index without physically purchasing each stock.

- Purchase mutual funds that follow the Nifty 50 index passively. By retaining identical stocks in comparable ratios, these funds seek to mimic the Nifty’s performance.

In comparison to actively managed funds, index mutual funds are usually managed by fund managers and have lower expense ratios.

- To get exposure to the index, use financial derivatives like Nifty futures and options. Derivatives trading, however, carries a larger risk and might necessitate a solid grasp of market dynamics.

Futures contracts allow investors to hedge their current portfolios or make predictions about the Nifty 50’s future trajectory.

- Invest in mutual funds that mimic the performance of the Nifty 50, known as Nifty 50 index funds. Diversification among the 50 stocks is the goal of these funds, which also seek to replicate the index composition.

Factors Affecting NIFTY

The Nifty 50 index is subject to fluctuation due to various reasons. Economic data, geopolitical developments, and market sentiment all matter. Enhancing investor confidence can result in an index trend upwards. Positive earnings reports, economic growth, and favorable policy developments can all help. In contrast, the index may fall as a result of sell-offs sparked by unfavorable economic data, geopolitical unrest, or corporate underperformance. Influencing stock prices and, by extension, the Nifty are changes in interest rates, inflation, and currency values.

The Nifty 50, which represents the general health of the Indian stock market, can also be influenced by developments in other global markets, especially those in major economies, and investor sentiment. The index’s responsiveness to changing market sentiment and economic conditions is a result of ongoing reviews of its composition and modifications based on market dynamics.

Also Read: How to Invest in US Stocks from India| A Comprehensive Guide

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Sarah J. Maas has a gift for writing dialogue that snaps with wit and tension. The banter between Aelin and her court provides much-needed levity amidst the darkness of the plot. Reading the text via a Queen of Shadows pdf allows you to appreciate the rhythm of the conversations. The humor is sharp and often used as a defense mechanism, which fits the traumatized nature of the characters perfectly. It makes them feel human and relatable, despite their magical abilities and royal titles.